An Assumption About Cost Flow Is Used

The method utilized to assign costs to inventory and cost of goods sold can have an effect on the companys profitability. 5 1 Ratings Solved.

Preparing Financial Projections And Monitoring Results Alberta Ca

Physical flow is focused on the actual movement of goods.

. The cost flow assumptions include FIFO LIFO and average. Average cost flow assumption is a calculation used by companies to assign costs to inventory goods cost of goods sold and ending inventory. The cost flow assumptions include FIFO LIFO and average.

Because of this cost differential management needs a formal system for assigning costs to. In the preceding example the May 10 unit would be assumed to have been sold. View the full answer.

If specific identification is used there is no need to make an assumption FIFO LIFO average are assumptions because the flow of costs out of inventory does not have to match the way the items were physically removed from inventory. Cost flow is an assumption about which goodsitems are sold. Average cost flow assumption is a calculation companies use to assign costs to inventory goods cost of goods sold COGS and ending inventory.

Types of cost flow assumptions. Answer The answer is Middle-in first out. If specific identification is used there is no need to make an assumption.

Accounting 2 Years Ago 65 Views. What are the three cost flow assumptions. Because of this cost differential management needs a formal system for assigning costs to inventory as they transition to sellable goods.

Thus the gross profit would be 11 and the ending inventory would be 27 13 14. An average is taken of all of the goods sold from inventory over the accounting period and that average cost is assigned to the goods. O Middle-in first-out O Average-cost O Last-in first-out O First-in first-out.

Instead of keeping up with the physical flow of inventory the company simply makes assumptions about the flow of costs which significantly increases the efficiency and effectiveness of the process. Average cost flow assumption is really a calculation companies use to assign costs to inventory goods price of goods offered COGS and ending inventory. Previous How much would a 25 carat diamond cost Next.

A typical is taken of all the goods offered from inventory within the accounting period which average cost is owned by the products. This is why cost flow assumptions are used. Largely stems from the presence of this tax rule.

The inventory cost flow assumption states that the cost of an inventory item changes from when it is acquired or built and when it is sold. The inventory cost flow assumption states that the cost of an inventory item changes from when it is acquired or built and when it is sold. If specific identification is used there is no need to make an assumption Click to see full answer.

We would like to show you a description here but the site wont allow us. Specific identification Maybe you like Silver chloride often used in silver plating contains 7527 Ag. The term cost flow assumptions refers to the manner in which costs are removed from a companys inventory and are reported as the cost of goods sold.

Understand the meaning of the LIFO conformity rule and realize that use of LIFO in the US. An average is taken of all of the goods sold from. First in first out FIFO 2.

Recognize that three cost flow assumptions FIFO LIFO and averaging are particularly popular in the United States. What r the answers to law of the donut math sheet. Following are common cost flow assumption.

The term cost flow assumptions refers to the manner in which costs are removed from a companys inventory and are reported as the cost of goods sold. Example of the Inventory Cost Flow Assumption. An assumption about cost flow is necessaryaonly when the flow of goods cannot be determinedbbecause it is required by the income tax regulationcbecause prices usually change and tracking which units have been sold is difficultdeven when there is no change in the purchase price on inventory.

100 7 ratings Solution. Perishable items must have an actual physical flow of FIFO. A business may adopt any cost flow assumption when accounting for perishable items.

Inventory Cost Flow assumption based on the oldest costs being transferred first from inventory to cost of goods sold so that the most recent costs remain in ending inventory. Last in first out LIFO 3. Identity of actual item sold is rarely known.

Premise that selling the oldest items first is more likely to mirror reality dont want inventory to lose freshness. Under the first-in first-out FIFO inventory cost flow method the first units purchased are assumed to be sold and the ending inventory is made up of the most recent purchases. Which of the following is not a common cost flow assumption used in costing inventory.

Average cost flow assumption is a calculation companies use to assign costs to inventory goods cost of goods sold COGS and ending inventory. An assumption about cost flow is used A because it is required by the income tax An assumption about cost flow is used a because it is School Central Michigan University. The physical inventory is only relevant to maintain the total number of units.

This Question has Been Answered. Previous question Next question. The cost flow assumptions include FIFO LIFO and average.

What is the Inventory Cost Flow Assumption. The cost flow assumption used in accounting for inventory is not necessarily consistent with the physical flow of the inventory.

An In Depth Explanation Of Code Complexity Dzone Performance Coding Software Development Life Cycle Old Quotes

Which Of The Following Is Not An Advantage Of Budgeting In 2022 Budgeting Accounting Principles Advantage

Ex Post And Ex Ante Economics Lessons Accounting And Finance Financial Management

Wealth Maximization Wealth Wealth Management Financial Management

Terminal Value In 2021 Accounting Education Accounting And Finance Enterprise Value

Advantages And Disadvantages Of Npv Learn Accounting Accounting Classes Financial Management

Break Even Analysis Templates 11 Free Printable Excel Word Pdf Examples Analysis Templates Fixed Cost

Periodic And Perpetual Inventory System Methods Examples Formulas

Tools On Finance Business Case Template Excel Templates Business Excel Tutorials

Modified Internal Rate Of Return Mirr The Solution To Multiple Irr Positive Cash Flow Financial Management Accounting And Finance

Break Even Analysis Tips Analysis Fixed Cost Assumptions

Inventory Costing Bookkeeping Business Accounting Basics Inventory Accounting

Pin By Billy The Goat On 100 Verified Good Grades Study Course Sales Presentation

Fifo Inventory Method Explained First In First Out Inventory Cost Flow Inventory Cost Cost Of Goods Sold App Development Process

Method For Estimating Working Capital Requirement Financial Life Hacks Accounting And Finance Learn Accounting

/brewers-talking--working-in-brewhouse-warehouse-1143537220-7745f3625a804fd895d36e21fdb073fc.jpg)

Average Cost Flow Assumption Definition

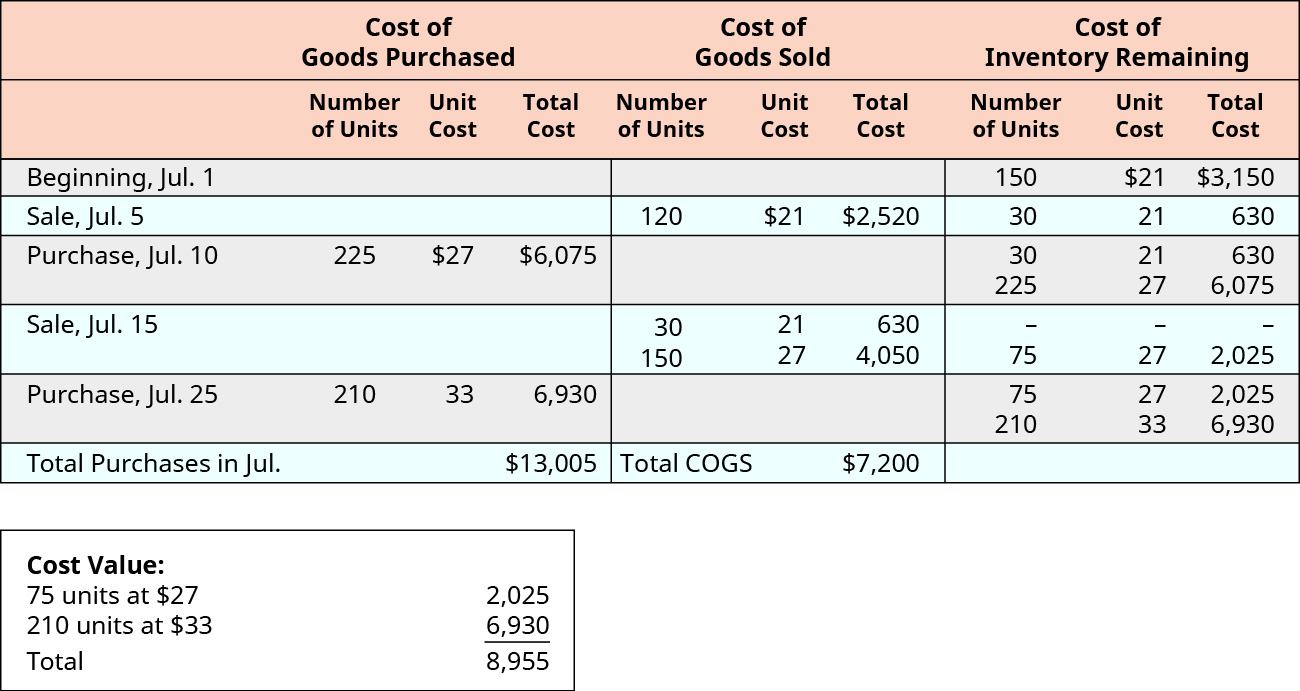

Calculate The Cost Of Goods Sold And Ending Inventory Using The Perpetual Method Principles Of Accounting Volume 1 Financial Accounting

Managerial Accounting Basic Cost Concepts Cost Accounting Managerial Accounting Accounting

Managerial Accounting Basic Cost Concepts Cost Accounting Managerial Accounting Accounting

Comments

Post a Comment